What is a Syndication?

A real estate syndication is a partnership in which investors collectively contribute capital to acquire large-scale assets that are often unattainable individually and share is the returns.

By investing passively in a commercial real estate, you avoid the hassles of tenants, maintenance, and daily operations. Each deal provides access to real estate markets and opportunities that might otherwise be unavailable or unaffordable, making syndications a great way to invest without going it alone.

The typical structure of a real estate syndication consists of General Partners (GPs), also known as syndicators, and Limited Partners (LPs).

General Partners oversee and manage the property, handling tasks such as acquisition, signing the loan, conducting due diligence, managing renovations, and overseeing daily operations. They have full liability for the company and its decisions.

Limited Partners are passive investors who contribute capital but are not involved in daily operations. Their liability is limited to their investment, meaning they have no personal liability beyond the amount they invested.

Our General Investment Criteria

Property Types: Class B multifamily, self-storage, and Mobile Home Parks

Markets: Midwest (MN, IA, WI) and South-Southeastern (Carolinas, GA) US.

1980+ Vintage

Strategy: Value-add

Hold period: 3-7 years

Performance Goals

Cash on cash returns of 7% or greater

16% to 20% IRR

17% or greater AAR

2.0x+ Equity Multiple

Deal Killers

High Crime

Median Household Income <3x the Pro-Forma Rents

Declining Population

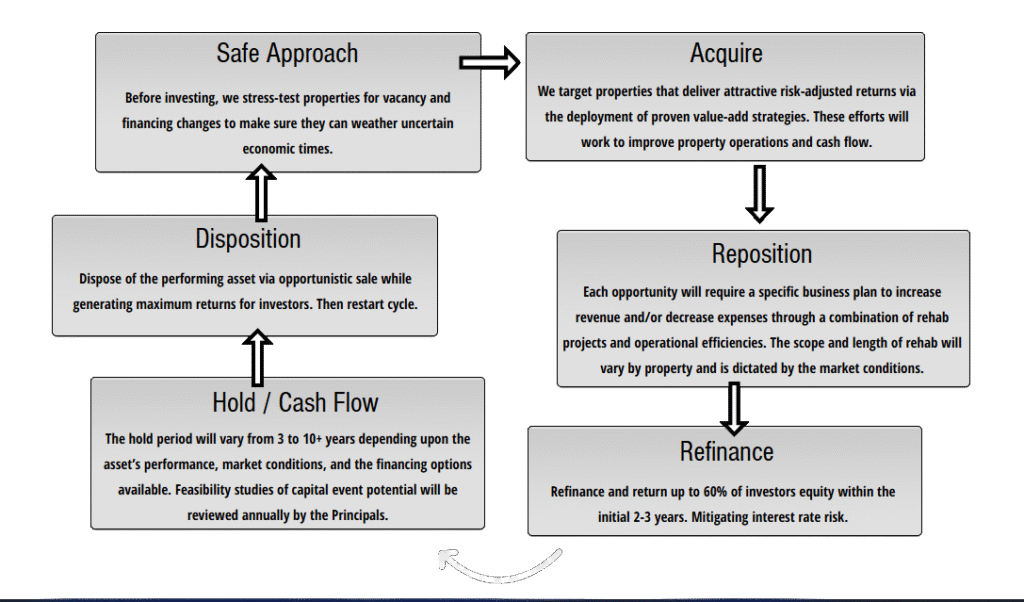

Our Investment Strategy

We specialize in the acquisition, repositioning, and management of value-add multifamily properties in growing markets to provide superior value and returns for our clients.

By using a value-add strategy, we maximize investor returns by identifying properties with improvement potential. We then implement upgrades and renovations to increase property value and generate higher rental income. Our goal is to boost the property’s net operating income (NOI) and cash flow, which in turn increases its value. Through these strategies, our investors can achieve significant returns while enhancing the quality of the property for tenants.

Safety of Investing in Commercial Real Estate

Growing Population

The current US population is roughly 334 million people with a net gain of one person approximately every 18 seconds.

Occupancy Rates

The national apartment occupancy rate is roughly 95%. This is despite the delivery of 565,000 new units in 2023, a high not seen since the mid-1980s.

Increase In Renters

The current home ownership rate is roughly 65.6% which is the lowest rate since it was 63% in 2015 & 1965. Furthermore, the home ownership rate for those under 35 averaged just 36% in 2023.

Inflation Hedge

When rental contracts are structured properly, lease expirations are staggered throughout the year, allowing for consistent rent adjustments. Each new lease presents an opportunity to increase rents, driving property value appreciation.

FAQ

Frequently Asked Questions

You can join our free Investor Community HERE. Investors in our Investor Community are the first to receive notifications of new deals.

A single-family home, duplex, triplex and quadraplex are considered residential properties. Anything more than 4 units is considered commercial multifamily.

Here are the key differences –

Valuation:

Residential properties are typically valued using a comparative sales approach with respect to recent sales of similar residential properties in the area.

Commercial Multifamily Properties are often valued using an income approach, specifically the capitalization rate (cap rate) method. The value is determined by the property’s ability to generate rental income. This approach considers the property’s net operating income (NOI), expenses, and prevailing cap rates in the market. Valuation for multifamily properties also considers comparable sales, but it places greater emphasis on the property’s potential rental income and its income-generating capabilities.

Lease Terms and Tenant Quality:

Residential property valuation doesn’t typically consider lease terms and tenant quality to the same extent as commercial properties.

Commercial Multifamily Valuation considers lease terms, tenant quality, and the potential for rent increases in commercial multifamily properties.

Income Potential: Multifamily properties often have higher income potential compared to residential properties because they can generate multiple rental incomes from different units. This can provide a more stable cash flow stream, especially in areas with a high demand for rental housing.

Economies of Scale: Multifamily properties may benefit from economies of scale. This can lead to reduced costs for maintenance, repairs, and other operational expenses, as certain costs can be distributed across multiple units.

Appreciation and Resale Value: While residential properties can appreciate in value, multifamily properties can have higher appreciation potential if they are located in areas with high population growth and strong rental demand. The potential for increased cash flow and property appreciation can make multifamily properties a lucrative investment in the long run.

Market Dynamics:

The residential market can be influenced by factors like school districts, neighborhoods, and individual home features.

Multifamily properties are often influenced by location, local rental market conditions, and the overall economic environment.

Cash on Cash Return (CoC)

Cash income earned relative to the original cash investment e.g. a property generating $10,000 in annual cash flow after debt service and initial cash investment of $100,000, has a 10% cash on cash return. A typical minimum CoC target for syndicated investments is 8-10%. It is not uncommon for the cash-on-cash return to be lower in Yr1-2, while the property is being updated.

Average Annual Return (AAR)

Return on investment averaged over the hold period of the asset, measured as total distribution to members divided by the initial cost of the investment or cash investment. A typical minimum AAR target for syndicated investments is approx. 15%+. It is not uncommon for the average return to be lower in Yr1-2, while the property is being updated and value-add work is ongoing.

Internal Rate of Return (IRR)

This metric captures the full return of the investment including distribution to members (referenced above) coupled with the gain on sale after accounting for time value of money, the timing of when cash flow is returned impacts the IRR. Therefore, the sooner you receive the cash back, e.g. the shorter the hold period, the higher the IRR. A typical minimum IRR target for syndicated investments is 15+ to 20+%.

Equity Multiple (EM)

Measured as total dollars received divided by total dollars invested. Total dollars received includes the cash flow earned throughout the hold period of the asset coupled with the sale proceeds. For example, if you invested $100,000 and you received a total of $200,000 throughout the hold period of the asset including gain on sale, that means you achieved equity multiple of 2.00x, or doubled your initial investment. A typical minimum EM target for syndicated investments is 1.50+ to 2.00+x.

It can vary depending on the deal, but typically $50K to $100K.